ABOUT US

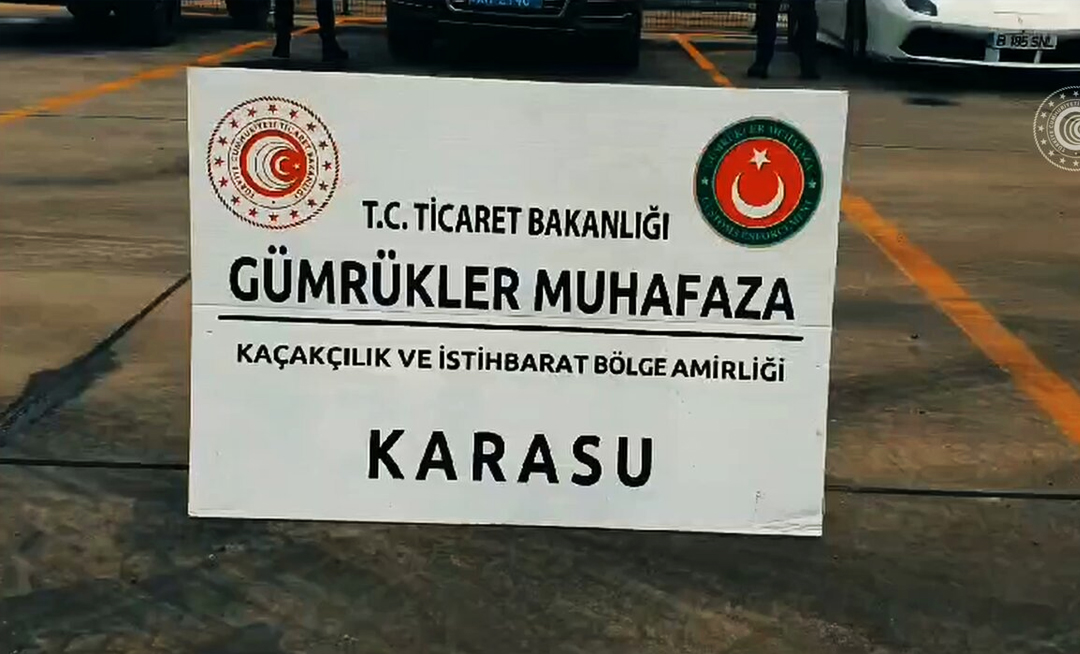

STA Customs Consultancy The Name of Speed, Transparency and Trust

We entered the customs consultancy sector in 2002 and grew along with the companies we served during this process. Now, with our 21 years of knowledge and experience, we are at your service as STA Customs Consultancy.

Speed: The business world is changing rapidly, and we are keeping up with this change. Speed is an indispensable feature for you to direct your business. By providing fast and uninterrupted service to our customers, we ensure that you carry out your business without any problems.

Transparency: Transparency lies at the core of our business. Open and honest communication at every step is a reflection of our commitment to our customers. We design our processes and decisions to always communicate clearly so that you can better understand your business.

VISION

STA Customs Consultancy The Name of Speed, Transparency and Trust

We entered the customs consultancy sector in 2002 and grew along with the companies we served during this process. Now, with our 21 years of knowledge and experience, we are at your service as STA Customs Consultancy.

Speed: The business world is changing rapidly, and we are keeping up with this change. Speed is an indispensable feature for you to direct your business. By providing fast and uninterrupted service to our customers, we ensure that you carry out your business without any problems.

Transparency: Transparency lies at the core of our business. Open and honest communication at every step is a reflection of our commitment to our customers. We design our processes and decisions to always communicate clearly so that you can better understand your business.

MISSION

STA Customs Consultancy The Name of Speed, Transparency and Trust

We entered the customs consultancy sector in 2002 and grew along with the companies we served during this process. Now, with our 21 years of knowledge and experience, we are at your service as STA Customs Consultancy.

Speed: The business world is changing rapidly, and we are keeping up with this change. Speed is an indispensable feature for you to direct your business. By providing fast and uninterrupted service to our customers, we ensure that you carry out your business without any problems.

Transparency: Transparency lies at the core of our business. Open and honest communication at every step is a reflection of our commitment to our customers. We design our processes and decisions to always communicate clearly so that you can better understand your business.

LATEST

NEWS

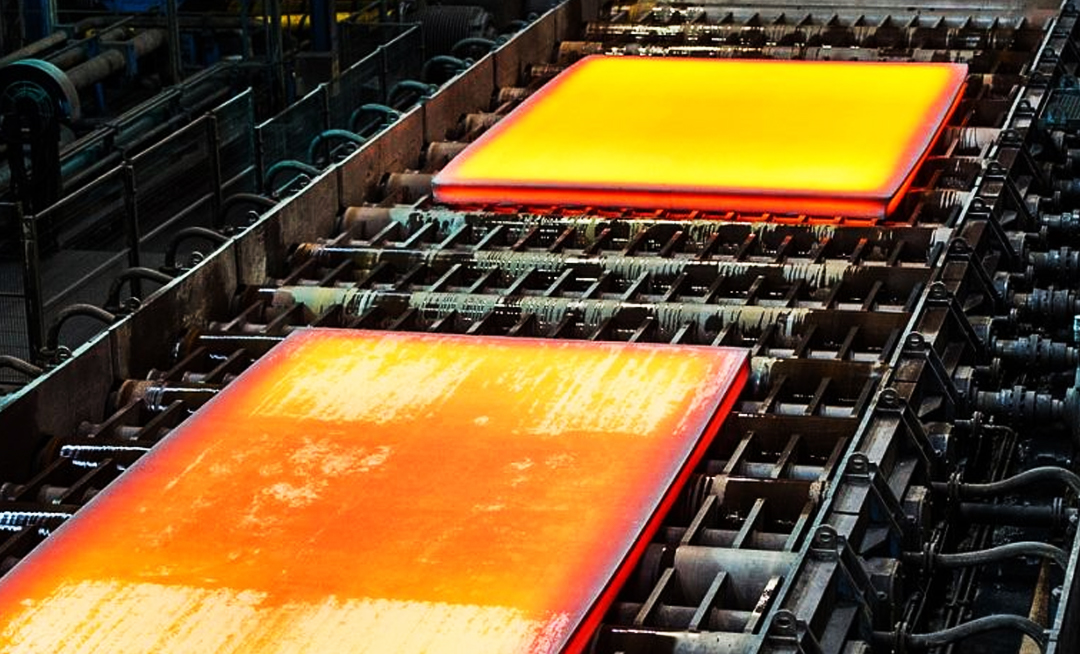

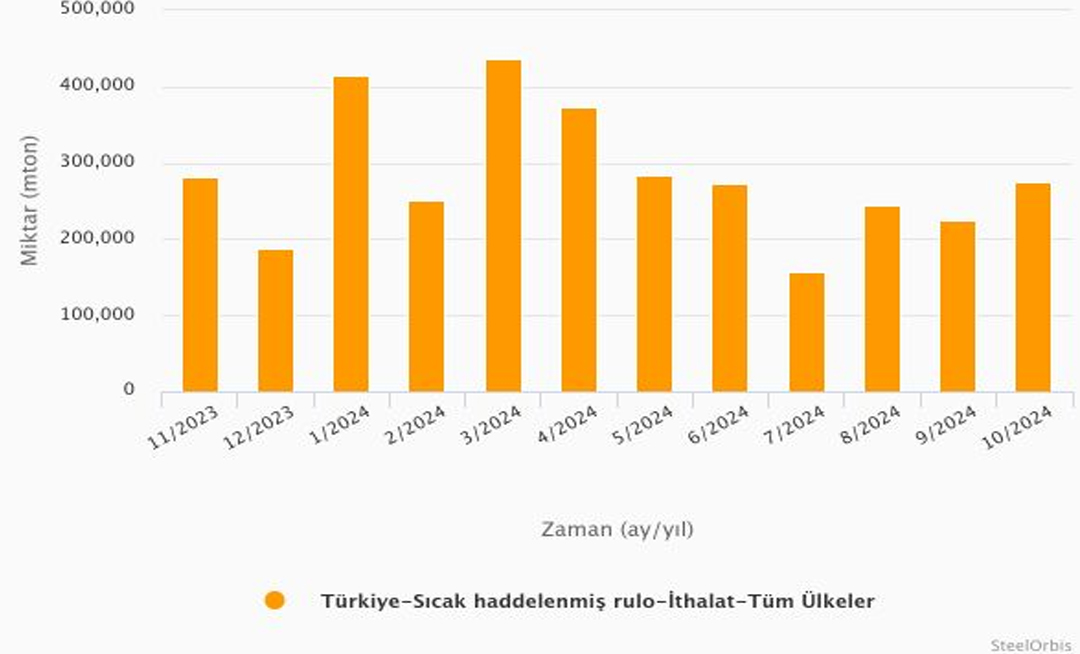

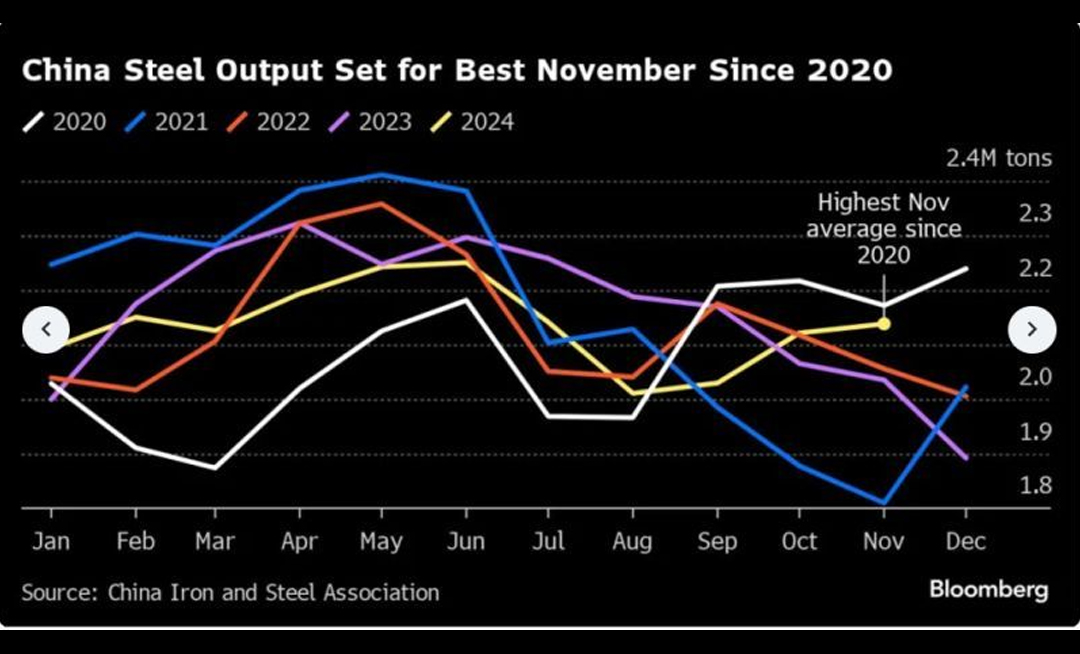

In response to the 25 percent tax imposed by US President Donald Trump on steel and aluminum imports, Turkey has developed new strategies by diversifying its export markets and increasing its competitiveness.

In response to the 25 percent tax imposed by US President Donald Trump on steel and aluminum imports, Turkey has developed new strategies by diversifying its export markets and increasing its competitiveness. The Ministry of Commerce aims to turn the increase in protectionism into an opportunity.

https://www.dunya.com/ekonomi/abden-abdnin-vergi-kararina-sert-yanit-gelecek-haberi-764071

Newly elected U.S. President Donald Trump denied claims that his aides are researching a customs tax plan that would be applied to every country but would only cover critical imports.

Newly elected U.S. President Donald Trump denied claims that his aides are researching a customs tax plan that would be applied to every country but would only cover critical imports.

A denial has emerged regarding claims that the team of newly elected President Donald Trump is at an important change stage in the additional customs tax plan that was among his promises.

In a statement on Truth Social regarding the news from the Washington Post, Trump stated that the report was incorrect, saying, "I will not back down from my customs tax policy."

https://www.bloomberght.com/trump-in-tarife-planinda-kritik-degisim-hazirligi-3738570

A temporary discounted customs tariff will be applied for 935 customs tariff numbers in imports to the People's Republic of China.

A temporary discounted customs tariff will be applied for 935 customs tariff numbers in imports to the People's Republic of China.

According to the announcement numbered 12 of the Tariff Commission of the State Council of China, dated December 26, 2024, a temporary discounted customs tariff lower than the MFN rate will be applied for imports to the PRC for 935 products starting from January 1, 2025. The mentioned statement and its appendices can be accessed on the official website of the Ministry of Finance of the PRC at lnkd.in

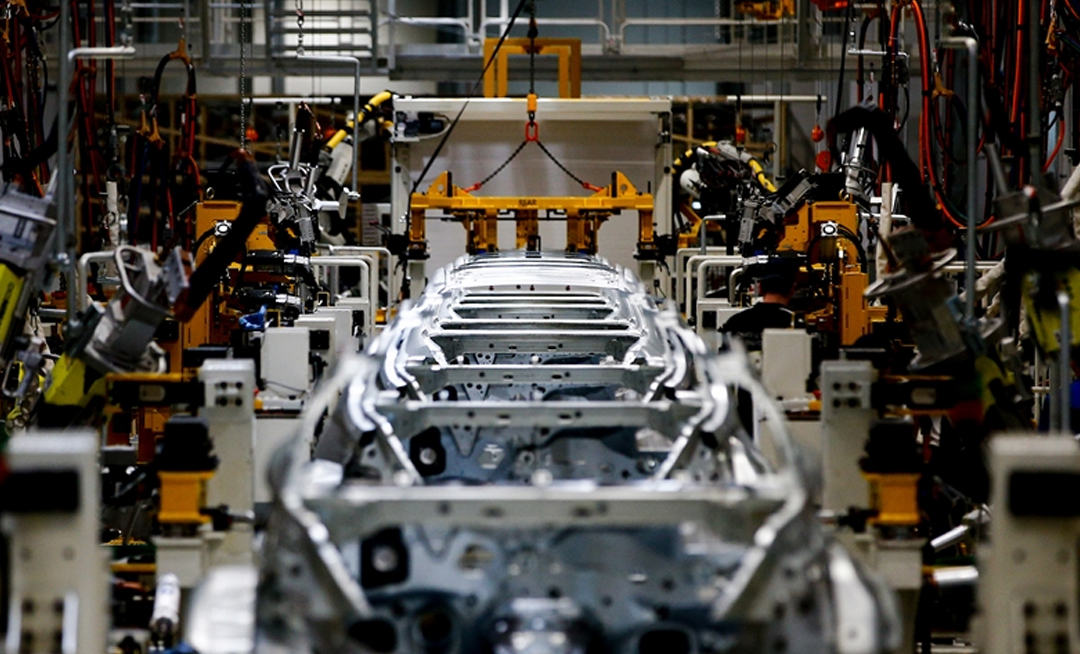

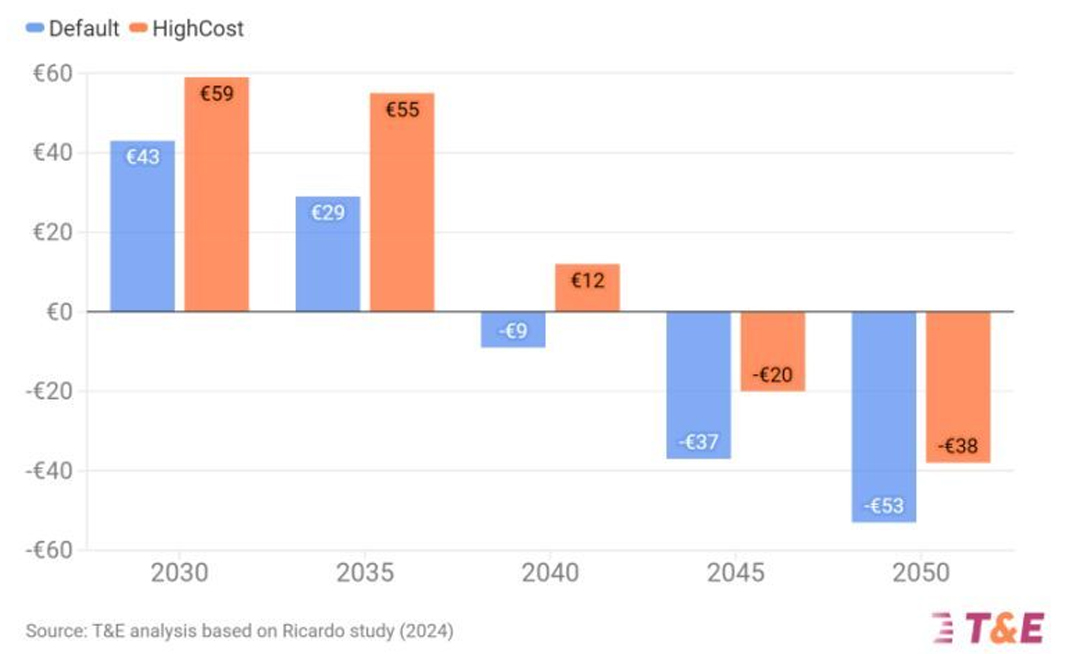

A new regulation has been implemented regarding additional customs duties on automobiles imported from China.

A new regulation has been implemented regarding additional customs duties on automobiles imported from China. The additional tax rate for internal combustion and hybrid vehicles originating from China has increased from 40% to 50%.

https://www.tgrthaber.com/ekonomi/cinden-gelen-araclara-fren-ek-vergilerde-vites-yukseldi-2990947

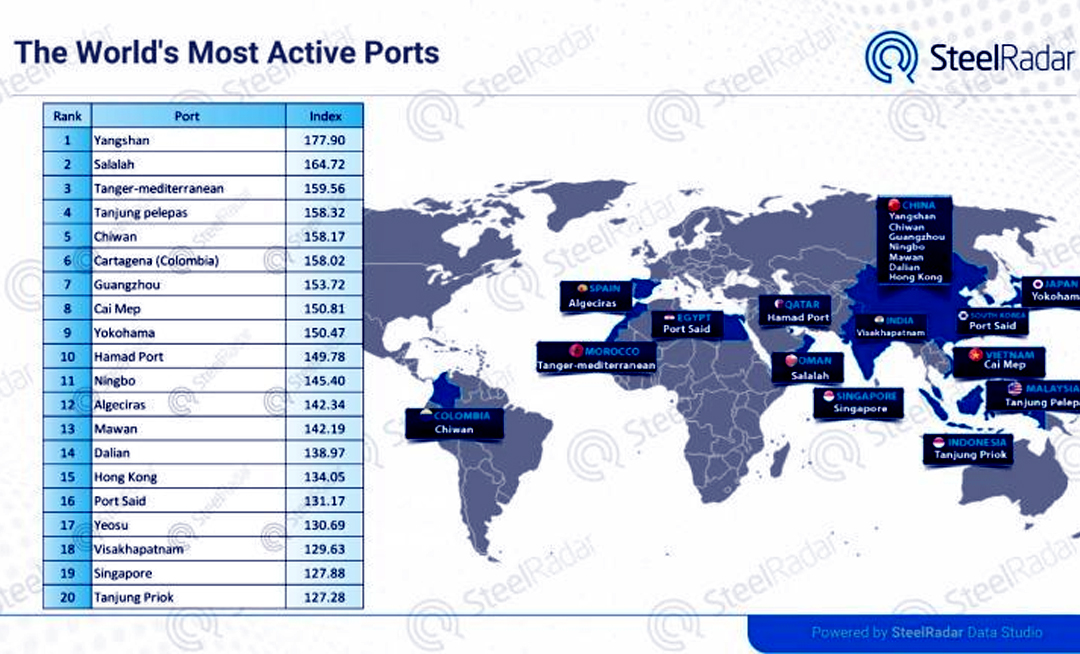

The Nigerian Customs Service (NCS) announced that it plans to recruit 3,927 new officers to strengthen its activities in the areas of trade facilitation and border security.

The Nigerian Customs Service (NCS) announced that it plans to recruit 3,927 new officers to strengthen its activities in the areas of trade facilitation and border security.

https://www.vanguardngr.com/2024/12/customs-to-recruit-3927-officers/#google_vignette

FUTURE WITH

STA GÜMRÜK!

We are here for career opportunities. If you would like to join the STA Customs family, we would be happy to inform you about our application process. You can fill out the application form or contact us to apply.

OUR SERVICES

EXPERT GUIDANCE IN CUSTOMS SERVICES

We provide consultancy on investment and incentive issues to help your business grow. We are here to help you make the most of government incentives.